The Exness minimum deposit refers to the minimum amount you need to fund your trading account. The good news is that Exness does not have a fixed minimum deposit across all account types. Instead, the minimum deposit varies depending on the payment method you choose and the account type you open. This means you can start trading with Exness with as little as $1 or even less.

However, the minimum deposit is just one factor to consider when selecting a broker. Other factors like spreads, commissions, leverage, instruments, and execution also play a role in your decision-making. In the following sections, we’ll walk you through how to choose the best deposit method and account type for your needs.

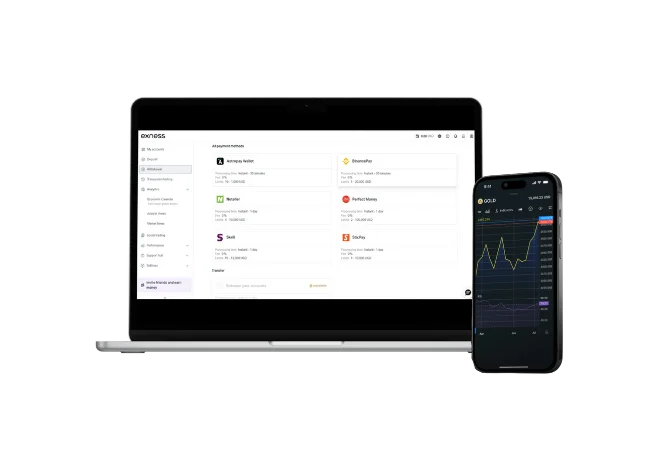

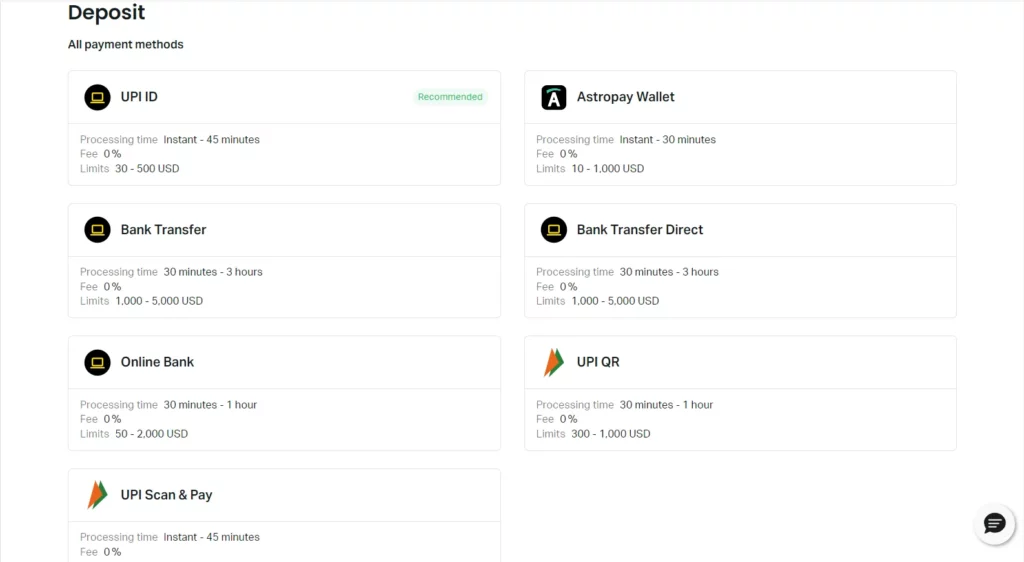

Exness Deposit Methods in Vietnam

Exness offers various deposit methods, including bank transfers, e-wallets, and international wire transfers. Each method has its own advantages and disadvantages, such as speed, fees, availability, and security. The most popular methods include:

- Bank cards:

Convenient and fast, with instant deposits and debits, but may incur fees, and card verification is required.

- Bank Transfer:

Secure and traceable, but slow due to bank processing times, with potential bank fees.

- E-Wallets:

Fast and easy, with instant or quick deposits, but requires account creation and identity verification, and there may be fees from Exness or the e-wallet provider.

- Cryptocurrency:

Can be used for larger amounts, though typically slower than other methods.

Exness Minimum Deposit Dependent on Payment Method

As mentioned earlier, the Exness minimum deposit depends on the funding method you choose. This means some methods may allow you to deposit less money than others. For example, you can deposit as little as ₫240,000 (roughly $10 USD) via certain payment methods, but others may require a higher deposit.

To help you choose the best Exness funding method for your trading needs, we have prepared a table showing the minimum deposit amounts for each method. Please note that these amounts are subject to change and may vary depending on your country and currency. Therefore, you should always check the latest information on the Exness website or in your personal area.

- MoMo – ₫240,000

- ZaloPay – ₫240,000

- ViettelPay – ₫240,000

- International Wire Transfer – ₫1,200,000

- Bank Transfer – ₫1,200,000

- Bitcoin – ₫240,000

Minimum Deposit for Vietnamese Traders

For Vietnamese traders, the minimum deposit depends on the chosen payment method and account type. Exness allows you to start trading with as little as ₫240,000-600,000 ($10-25 USD). With over 150,000+ active Vietnamese traders, Exness is a popular choice in cities like Ho Chi Minh City, Hanoi, and Da Nang.

While the minimum deposit is important, other factors such as spreads, commissions, leverage, instruments, and execution are equally critical. Exness supports popular payment methods like MoMo, ZaloPay, and ViettelPay, which allow easy, fee-free deposits and withdrawals with a minimum of ₫240,000. To use these methods, you need a verified Exness account and the respective e-wallet app.

Always compare deposit methods based on speed, fees, availability, and security. Detailed information is available on the Exness website or in your personal area.

Minimum Deposits for Different Account Types

Exness offers five account types: Standard, Standard Cent, Pro, Zero, and Raw Spread. Each differs in spreads, commissions, leverage, instruments, and execution. Choose the one that aligns with your trading goals.

The minimum deposit in Vietnam depends on the payment method and region. Generally, Standard and Standard Cent accounts have no set minimum deposits, while Pro, Zero, and Raw Spread accounts require at least ₫4,800,000 ($200) for the first deposit. Below is a summary of the minimum deposits for each account type:

Standard Account

Ideal for beginners and experienced traders. Features market execution, fixed spreads, no commissions, and unlimited leverage. Minimum deposit starts as low as ₫240,000, depending on the payment method.

Standard Cent Account

Similar to Standard but for micro lots (0.01 of a standard lot). Minimum deposit starts at ₫240,000 with e-wallets like MoMo.

Pro Account

For professional traders seeking low spreads, high leverage, and fast execution. Charges ₫7,000 per side per lot and offers more instruments like stocks and indices. Minimum first-time deposit is ₫4,800,000, but may vary by region.

Zero Account

For advanced traders wanting zero spreads, high leverage, and market execution. Charges ₫7,000 per side per lot, offering the best prices and liquidity. Minimum first-time deposit is ₫4,800,000, but may vary by region.

Raw Spread Account

For experienced traders seeking extremely low, stable spreads. Charges a fixed commission per lot, depending on the instrument. Minimum first-time deposit is ₫4,800,000, but may vary by region.

Commission on Exness Deposits

Exness does not charge fees or commissions on deposits. However, your bank, card provider, or e-wallet may apply transaction fees beyond Exness’s control. Check the terms and conditions of your payment method before depositing.

Some methods may also incur a currency conversion fee if you deposit in a currency different from your account’s currency. For example, depositing USD into a VND account may result in a conversion fee. To avoid this, choose a payment method that supports your account’s currency.

Here’s a table with deposit options in Vietnam:

| Deposit Method | Commission | Processing Time |

|---|---|---|

| Bank Transfer | $0 | 3-5 business days |

| MoMo | $0 | Instant |

| ZaloPay | $0 | Instant |

| ViettelPay | $0 | Instant |

| International Wire Transfer | $0 | Up to 5 business days |

| Cryptocurrency | $0 | Up to 72 hours |

How Long Does a Deposit Take?

Deposit speed depends on the payment method. Most methods, such as MoMo, ZaloPay, ViettelPay, and domestic bank cards, offer instant or near-instant deposits, crediting funds to your Exness account within seconds or minutes. Bank transfers and international wire transfers may take 3-5 business days due to bank processing times. Always check the processing time for your chosen method.

Which Currencies Are Accepted for Deposits?

Exness accepts deposits in various currencies, including VND, USD, EUR, GBP, JPY, and BTC, depending on the payment method and region. If your deposit currency does not match your account currency, you may incur conversion fees from your payment method or Exness. To avoid this, select a payment method that supports your account’s currency, such as VND for Vietnamese traders.

Vietnamese Foreign Exchange Regulations

In Vietnam, foreign exchange transactions are regulated by the State Bank of Vietnam (SBV) under Decree 70/2017/ND-CP on foreign exchange regulations. Traders must comply with these regulations when depositing or withdrawing funds, especially for international wire transfers or cryptocurrency transactions. Additionally, the State Securities Commission of Vietnam (SSC) oversees securities trading, ensuring compliance for instruments like stocks and indices. Always ensure your transactions align with SBV and SSC regulations to avoid issues.

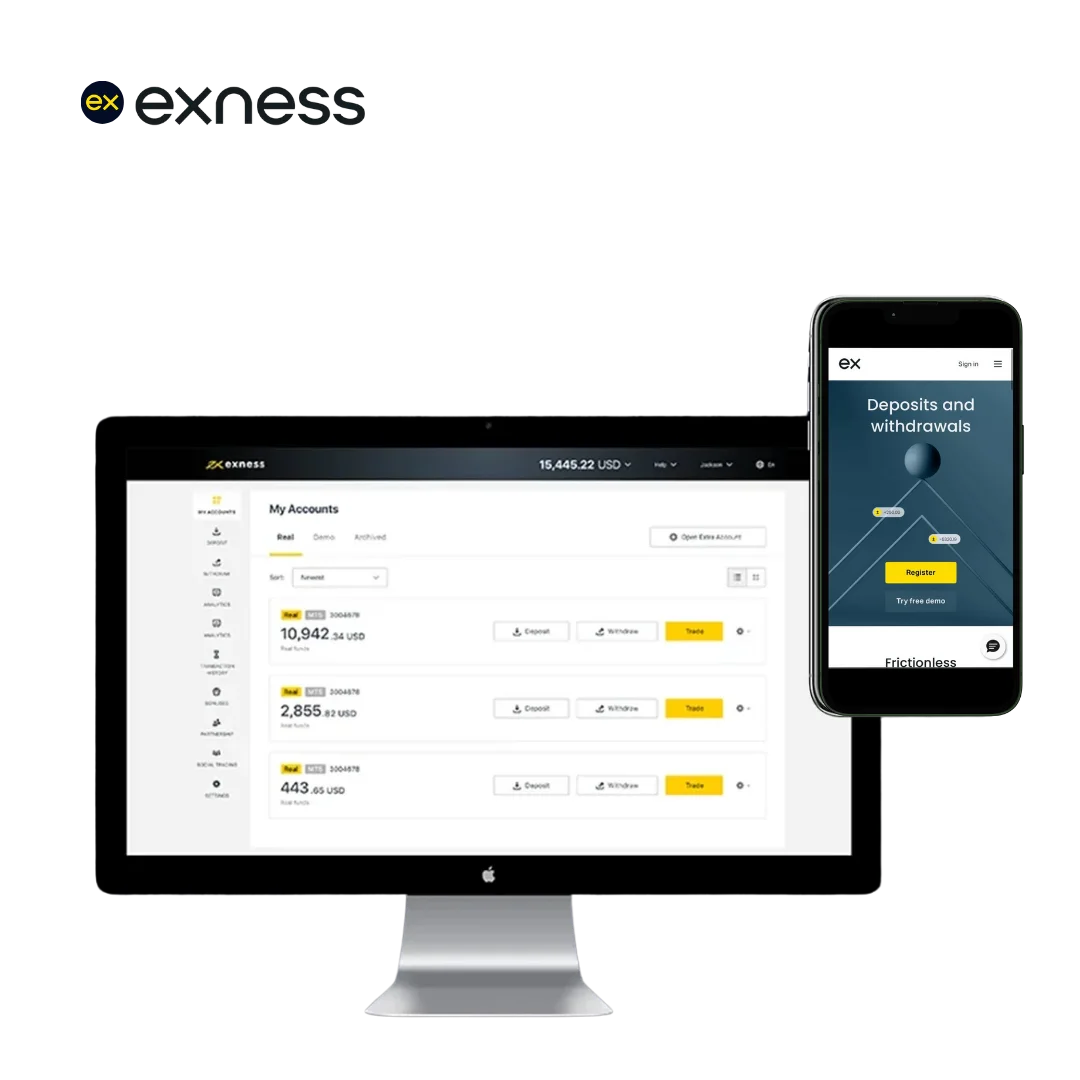

How to Make a Minimum Deposit With Exness

To make a minimum deposit with Exness in Vietnam, follow these steps:

- Log in to your personal area on the Exness website.

- Go to the Deposit section and choose a payment method (e.g., MoMo, ZaloPay, bank transfer). You’ll see the minimum and maximum deposit amounts, processing time, and fees for each method.

- Select the trading account you wish to fund or create a new Exness account if needed.

- Enter the deposit amount (e.g., ₫240,000 or more) and currency, then click Next. A summary of your deposit details and exchange rate (if applicable) will appear.

- Confirm your deposit and follow the instructions for your payment method to complete the transaction. You’ll receive a confirmation email upon successful deposit.

Questions to Ask

Are there any commission-free deposits on Exness?

Exness does not charge fees or commissions on deposits. However, your payment method (e.g., bank or e-wallet) may impose charges beyond Exness’s control.