- seamless deposits

- 24/7 access

- hassle-free release of funds

This renowned Forex broker is regulated by seven trusted authorities, such as the UK’s FCA and Cyprus’s CySEC, while it is a market leader with a range of different trading products. There are cryptocurrencies, forex pairs, stocks, energies, metals, and others.

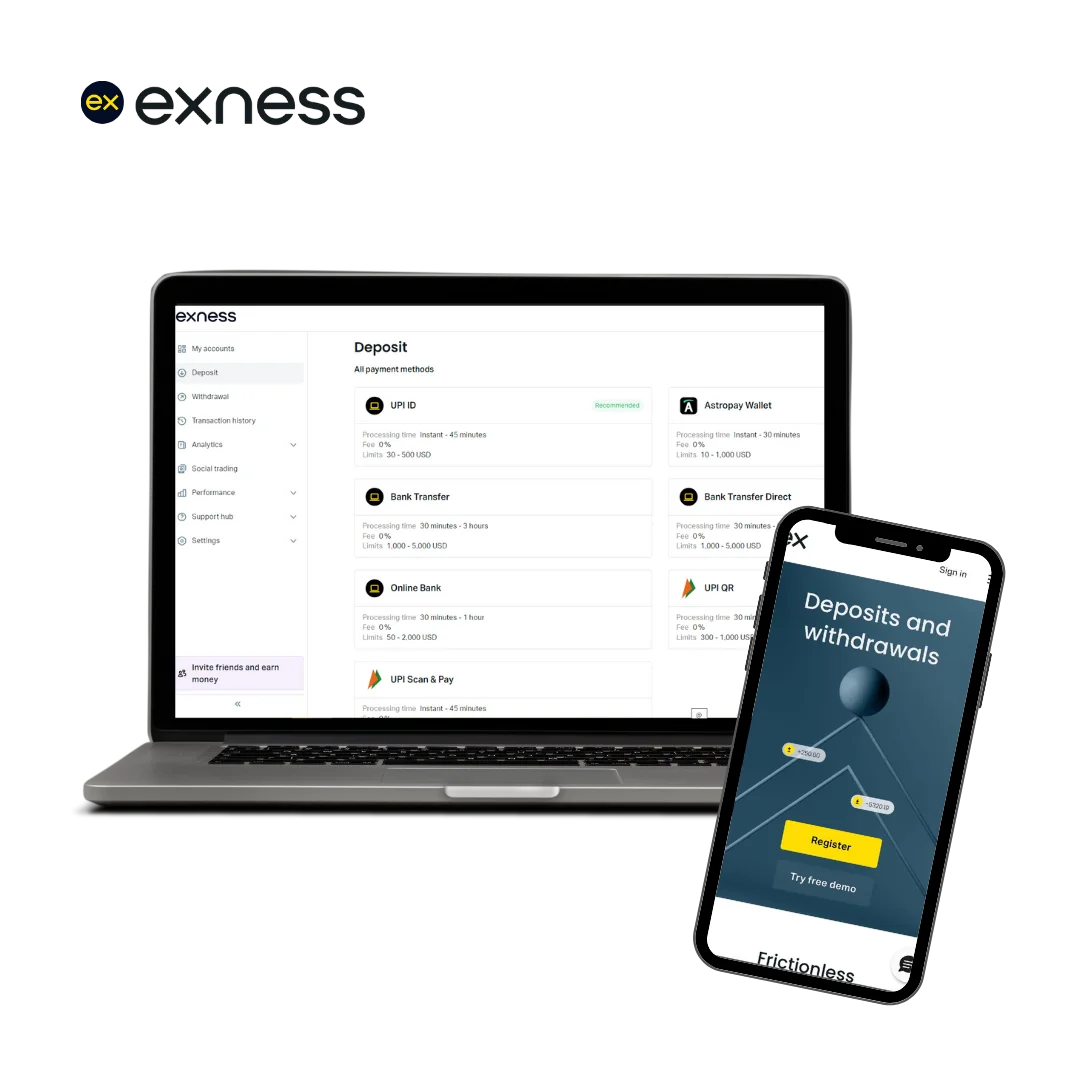

In addition to favorable trading conditions and a wide range of tradable products, Exness offers convenient deposits and withdrawals via methods like bank wire transfers (chuyển khoản ngân hàng), domestic bank cards, e-wallets such as MoMo, ZaloPay, ViettelPay, and international wire transfers. For traders in Vietnam, Exness provides local Vietnamese support (Tiếng Việt) alongside English. However, it is necessary for the beginning trader to understand these processes to be well-organized and fully grasp the deposit and withdrawal procedures available for online trading.

This guide will provide key information on the deposit and withdrawal measures available when transacting with Exness in Vietnam, including compliance with Decree 70/2017/ND-CP on foreign exchange regulations. We’ll walk through typical time frames expected from the merchant when making deposits and withdrawals, as well as examine tips for speeding up your withdrawals.

Available Financing Methods and Base Currencies

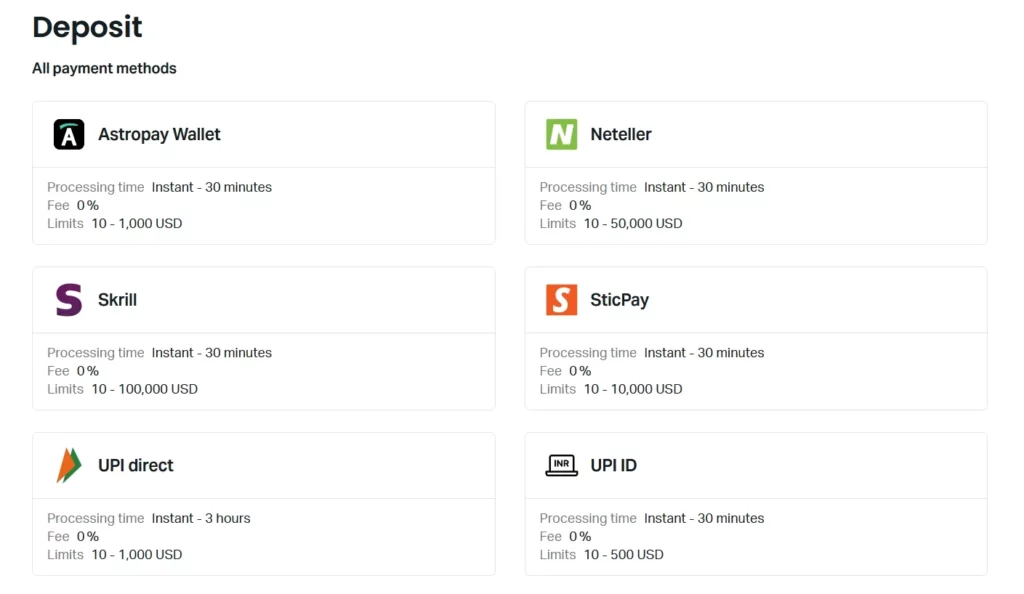

Exness offers a variety of payment options tailored for Vietnamese traders, each with its own minimum deposit limit and processing time. Here is a list of financing methods available for Exness traders in Vietnam:

- Bank wire transfer

- Domestic bank cards

- E-wallets: MoMo

- International wire transfers

Popular banks in Vietnam include Vietcombank (Bank for Foreign Trade of Vietnam), BIDV (Bank for Investment and Development of Vietnam), VietinBank (Vietnam Bank for Industry and Trade), Techcombank (Vietnam Technological and Commercial Joint Stock Bank), ACB (Asia Commercial Bank), MB Bank (Military Bank), and VPBank (Vietnam Prosperity Joint Stock Commercial Bank).

Keep in mind that different regions in Vietnam may support different payment methods, so check the options available in your area (e.g., Ho Chi Minh City, Hanoi, Da Nang) before making a deposit. You can find the full list of payment methods in your Personal Area.

Exness base currencies

Exness displays different base currencies depending on the trading account type. For the Standard Account, you can use currencies such as:

ARS, AED, AZN, AUD, BND, BHD, CHF, CAD, CNY, EUR, EGP, GHS, GBP, HUF, HKD, IDR, JPY, JOD, KRW, KES, KWD, KZT, MXN, MAD, MYR, NZD, NGN, OMR, PHP, SAR, QAR, SGD, UAH, USD, UGX, UZS, XOF, VND, ZAR.

Note that you cannot change the base currency after setting up a trading account. Thus, depositing in a different currency will incur a conversion fee. It’s important to select the right base currency, such as VND, to avoid unnecessary expenses. You can open multiple Exness trading accounts with different base currencies in the same Personal Area.

Exness Deposit Overview

When depositing cash into your Exness trading account in Vietnam, you have several banking options, including:

- Domestic Bank Cards: Exness accepts major domestic bank cards from banks like Vietcombank, BIDV, VietinBank, Techcombank, ACB, MB Bank, and VPBank. Enter your card details and the amount to deposit. This option is fast and simple, but your bank may charge a transaction fee.

- E-Wallets: Exness supports popular Vietnamese e-wallets like MoMo, ZaloPay, and ViettelPay. Link these wallets to your Exness trading account for instant deposits.

- Bank wire transfers: Exness allows traders to fund their accounts via wire transfers from Vietnamese banks. Obtain Exness account details and access your bank’s online portal or visit a branch in Ho Chi Minh City, Hanoi, or Da Nang. Funds typically appear within 72 hours, with no fees from Exness.

- International Wire Transfers: For larger transactions, international wire transfers are available, subject to Decree 70/2017/ND-CP on foreign exchange regulations. Ensure compliance with the State Bank of Vietnam (SBV) guidelines.

How to Deposit in Exness

Follow these steps to fund your Exness account:

- Go to the official Exness site or app and log in to your Personal Area. New traders in Vietnam should first create an account.

- Click on the “Deposit” option in the side menu.

- Choose your preferred payment method, such as domestic bank cards, MoMo, ZaloPay, ViettelPay, or bank wire transfers.

- Enter your Exness account number, select VND as your base currency, and input the deposit amount (minimum ₫240,000-600,000, approximately $10-25 USD). Click “Next.”

- Verify your deposit details and confirm the payment.

- Your browser or app will redirect you to your payment provider. Follow the on-screen instructions to approve the payment request. Funds will reflect in your account upon approval.

Exness Deposit limits and fees

Deposits must meet specified limits, and fees may apply depending on the payment method. For example:

- Standard Account: Minimum deposit of ₫240,000 ($10 USD).

- Professional Account: Minimum deposit of ₫4,800,000 ($200 USD).

Minimum deposit limits by payment method:

- Domestic Bank Cards: ₫70,000 ($3 USD)

- E-Wallets (MoMo, ZaloPay, ViettelPay): ₫240,000 ($10 USD)

- Bank Wire Transfer: Varies by bank

- International Wire Transfer: Varies by bank, subject to SBV regulations

Exness generally does not charge deposit fees, but your payment provider may apply transaction fees. Most deposit methods are instant, transferring funds within seconds after approval.

Benefits of depositing funds in Exness

Exness ensures deposits are easy, fast, and secure for Vietnamese traders:

- Deposits are available even during public holidays and weekends.

- Most deposits are free, though some banks or e-wallet providers may charge fees.

- Deposits are secure, with no third-party payments allowed.

- Instant deposit methods like MoMo, ZaloPay, and ViettelPay enable trading within minutes.

- Standard accounts have low minimum deposit requirements (₫240,000).

Exness Deposit Bonus

Exness does not offer deposit bonuses, aligning with its core values. Instead, Vietnamese traders can earn steady income through the Exness partnership program, earning up to 40% of revenue per referred trader or up to $1850 per client via the affiliate program.

Exness Withdraw Guide

Withdrawal options for Vietnamese traders include:

- Domestic Bank Cards: Withdrawals via major cards are processed within one trading day, subject to bank fees and limits.

- Bank Wire Transfers: Request transfers to accounts at Vietcombank, BIDV, VietinBank, etc. Processing takes 1-3 business days, with no Exness fees.

- E-Wallets: Withdraw to MoMo, ZaloPay, or ViettelPay for instant or near-instant transfers, though third-party fees may apply.

- International Wire Transfers: Subject to Decree 70/2017/ND-CP and SBV regulations, processing takes 3-5 business days.

How to withdraw funds from Exness

To withdraw funds:

- Log in to your Exness Personal Area.

- Select “Withdraw” from the left menu.

- Choose your preferred method (e.g., MoMo, bank transfer).

- Enter your Exness account details, select VND, and specify the withdrawal amount. Click “Next.”

- Verify your withdrawal details and enter the SMS code received.

- Provide your payment account details (e.g., bank name for Vietcombank or ZaloPay account) to complete the transaction.

Exness withdraw time

Withdrawal times vary by method:

- Bank Wire Transfer: 3-5 business days.

- Domestic Bank Cards: Up to 7 business days.

- E-Wallets (MoMo, ZaloPay, ViettelPay): Instant to 24 hours.

- International Wire Transfers: Up to 72 hours.

- Cryptocurrencies: Up to 72 hours.

Check the Exness website for region-specific details.

Exness Withdraw Limits and Fees

To ensure fairness and transparency, Exness has several policies regarding withdrawal limits and fees. Here are some important points:

- Exness does not charge withdrawal fees, but third-party processors may.

- Minimum withdrawal: ₫24,000 ($1 USD) for most methods; ₫1,200,000 ($50 USD) for bank transfers.

- Withdrawals must comply with SBV and SSC (State Securities Commission of Vietnam) regulations, including Decree 70/2017/ND-CP.

Exness withdrawal issues

Common issues include:

Incorrect Details

Double-check account and bank details (e.g., Vietcombank account number) to avoid delays.

Incomplete Verification

Unverified accounts face limits due to KYC and anti-money laundering policies enforced by SBV and SSC. Upload valid identity and address proof.

Different Payment Methods

Use the same method for deposits and withdrawals to avoid issues.

Technical Issues

Contact Exness support for assistance with server downtime or maintenance.

Trade with the Exness Mobile App

For smooth trading, Exness offers a secure mobile trading application that provides a desktop-like experience to meet the needs of all traders. Traders can access features and tools not available in the desktop version through their smartphones.

The Exness mobile app offers a desktop-like experience for Vietnamese traders, with features like:

- Access to indicators for chart analysis.

- Real-time economic trends and market news.

- Management of trading accounts, including demo accounts.

- Investment calculators for swaps, spreads, and margins.

The app supports instant deposits via MoMo, ZaloPay, or ViettelPay, access to over 130 financial instruments, and withdrawals. Local Vietnamese support (Tiếng Việt) is available.

Security Measures for Secure Transactions

Exness ensures safe trading with:

- Strong Encryption: Protects personal data.

- Two-Factor Authentication: Requires a password and SMS code.

- Segregated Accounts: Keeps client funds separate from company funds.

- KYC Compliance: Verifies identity to prevent fraud, in line with SBV and SSC requirements.

Compliance with Decree 70/2017/ND-CP ensures adherence to Vietnam’s foreign exchange regulations.

Split customer accounts

To protect Vietnamese traders’ funds, Exness has implemented segregated client accounts, ensuring that your funds are kept separate from the company’s funds. This practice, compliant with regulations set by the State Bank of Vietnam (SBV) and the State Securities Commission of Vietnam (SSC), reduces the risk of funds being misused or misappropriated. It adds a layer of transparency and security for traders in Ho Chi Minh City, Hanoi, and Da Nang, aligning with Decree 70/2017/ND-CP on foreign exchange regulations.

Compliance with KYC requirements

To verify the identity of its traders, Exness adheres to strict Know Your Customer (KYC) requirements in line with SBV and SSC regulations. When opening an account, Vietnamese traders must provide documents verifying their identity and address, such as a national ID card or proof of residence. This helps prevent money laundering, ensures the confidentiality of funds, and combats other illegal activities, maintaining the platform’s integrity and protecting traders’ interests across Vietnam.

Tips for a Simple Transaction Process

To ensure a simple and user-friendly experience when depositing and withdrawing your funds on Exness, here are some practical tips to remember:

- Quickly verify your account by providing supporting documents so there are no deposit or withdrawal restrictions.

- Find out your account balance so that you have enough funds in your account before you submit a withdrawal request.

- If you encounter any technical issues with your deposits or withdrawals, contact the customer support team for assistance.

- Use the same payment method for all your deposits and withdrawals so you won’t have any potential problems receiving your funds.

- Double check banking details when making deposits and withdrawals so that there are no delays or processing errors.

Customer Support and Assistance

Exness offers 24/7 support in Vietnamese (Tiếng Việt) and English via live chat, email, or phone. Provide your support PIN and account number for assistance. Contact support for details on compliance with SBV, SSC, or Decree 70/2017/ND-CP.

Conclusion

Exness provides a seamless deposit and withdrawal experience for Vietnamese traders in Ho Chi Minh City, Hanoi, and Da Nang. By following this guide and leveraging local payment methods like MoMo, ZaloPay, and Vietcombank transfers, you can manage your funds efficiently while complying with Vietnam’s regulations.

FAQs about Exness Payments

What deposit and withdrawal methods are available at Exness in Vietnam?

Exness offers bank transfers (chuyển khoản ngân hàng), domestic bank cards, e-wallets (MoMo, ZaloPay, ViettelPay), and international wire transfers. Availability varies by region.